tax act stimulus check error

I used Tax Slayer and am having the same problem. The stimulus payments are an advance on a tax credit specifically designated for the 2020 tax year.

Trouble Getting Your Stimulus Check Here Are Your Options Smartasset

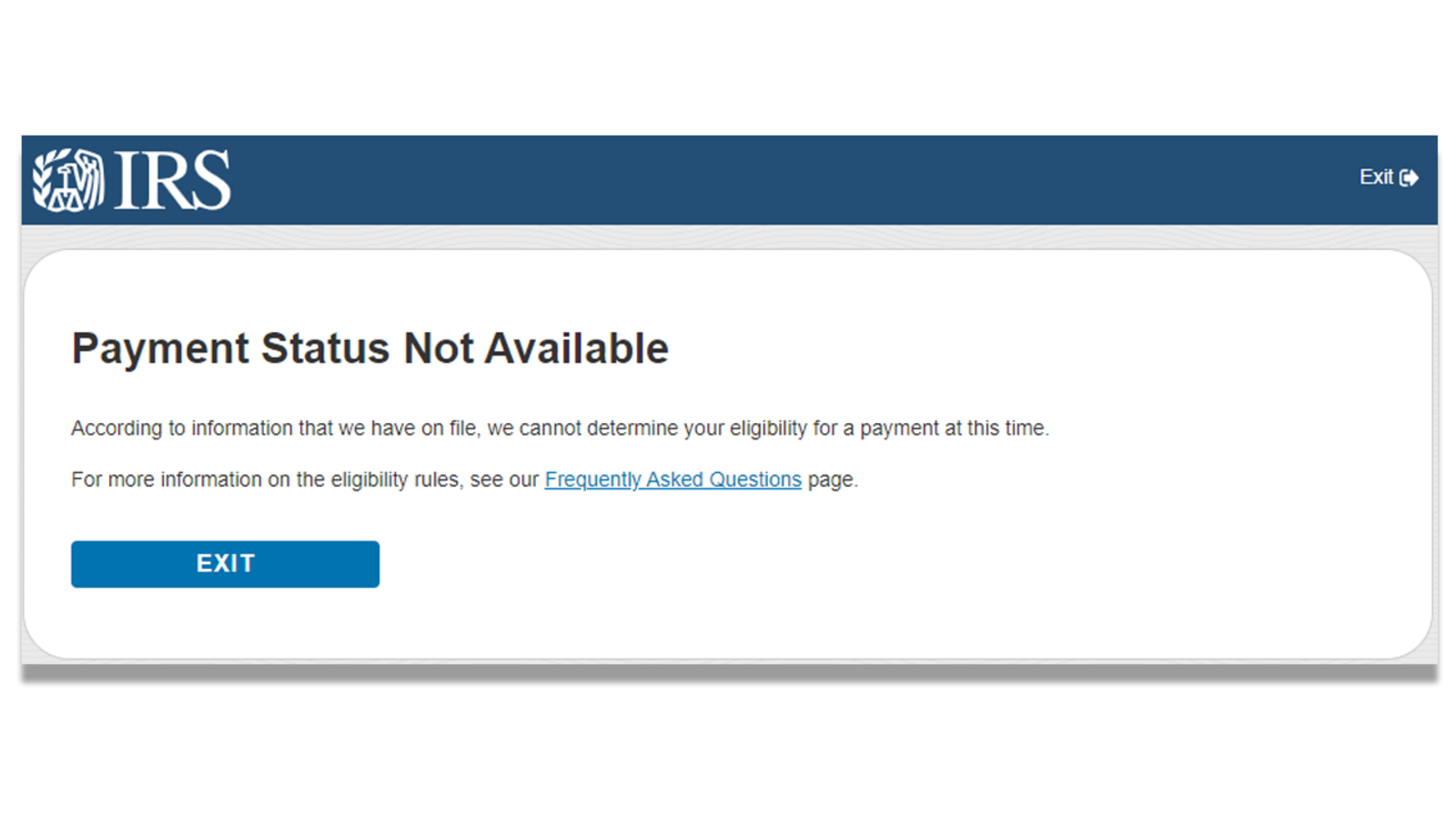

Transcript says 14 and the check my payment or whatever its called shows status not available.

. The Consolidated Appropriations Act 2021 added additional funds to this credit which basically serves as a second stimulus payment for most taxpayers. The more recent Coronavirus Response and Relief Supplemental Appropriations Act passed at the end of December called for additional stimulus payments of up to 600 per adult 1200 for couples. The list of addresses is available on the IRS website.

Transcript says 14 and the check my payment or whatever its called shows status not available. Yes if your 2020 has been processed and you didnt claim the credit on your original 2020 tax return you must file an Amended US. We filed with Tax Act and had our fees taken out of our return.

Thousands Possibly Millions Haven T Received. Your stimulus payment will be direct deposited into your verified bank account. Jackson Hewitt and TaxAct say missing stimulus checks will be deposited starting Feb.

IRS was at half speed for two weeks then shut down for a month and now again at half speed while trying to catch up on the backlog. But the IRS states. If you didnt get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you dont usually file taxes - to claim it.

Click Add Form 1099-INT. Hell have to wait to pick up the rest of the EIP on the 2020 return. It told me my tax refund and the 3rd stimulus of 1400.

Of note the IRS is also using information from this seasons returns to process the new 1400 stimulus checks or potentially top up those payments. Individual Income Tax Return Form 1040-X to claim the creditThe IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return. After completing it I e-filed my taxes.

TurboTax and HR Block customers are reportedly struggling to get their stimulus checks once again but. If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this. Hell have to wait to pick up the rest of the EIP on the 2020 return.

Im so confused on whats going on and our stimulus is no where to be found. If you make a mistake on the Line 30 amount the IRS will calculate the correct amount of the Recovery Rebate Credit make the. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected.

Click Review bank account information. The Recovery Rebate Credit was added for 2020 as part of the CARES Act to reconcile your Economic Impact stimulus payment on your 2020 tax return. If you are unable to resolve your issues with the IRS and are eligible for direct assistance generally you are one of the taxpayers identified in 1-7 above and you meet TAS criteria TAS can.

Mail the check and the note to the IRS location based on the state you live in. January 11 2021 1004 AM CBS DFW. Enter 1 in Box 1 Interest income.

The second round of stimulus payments are based on the information reported on your 2019 tax return. WASHINGTON Taxpayers requesting an extension will have until Monday Oct. The TurboTax software adds together the entries that you made for receiving stimulus check 1 and stimulus check 2.

We filed with Tax Act and had our fees taken out of our return. DALLAS CBSDFWCOM - After the IRS sent millions of stimulus payments to the wrong bank accounts tax preparation companies said theyve worked with the IRS. If you received the full amount you.

If you received an erroneous direct deposit or you already cashed. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and didnt know there was a third stimulus so I said no. Second Stimulus Check Update Heroes Act Passes In The House.

This modal can be closed by pressing the Escape key or activating the close button. Write a note to include with the check explaining why it is being returned. Since both stimulus payments were sent out before the 2020 tax return was filed the IRS used the information they had on file for individuals from their 2019 tax returns to determine the amount of money each qualifying person should receive.

I was told because we chose to pay our tax preparation fee out of our 2019 refund the stimulus was deposited into their HR Block bank account instead of. Id be more concerned about the child tax credit he missed out on than the EIPan amended return wont complete processing for 6 months or probably more. The important details you want to know.

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund. However there is also a chance that you miscalculated how much money you would receive. Using the total amount of the third payments from the individuals online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Enter and verify bank account information complete all steps. It told me my tax refund and the 3rd stimulus of 1400. If you are due an additional amount it will be issued as a Rebate Recovery Credit RRC on line.

Currently the second stimulus payout is as follows for those eligible. People who do not receive their stimulus payment by the January 15 deadline will have to wait to claim their stimulus check as a tax credit when they file their 2020 taxes. We use chase for our bank.

Then the software computes the amount of your stimulus check amounts based upon the information that has been entered into the tax software. Write void in the endorsement section on the back of the check.

4th Stimulus Check Has Not Been Passed Ktvb Com

Stimulus Check Problems Result In Irs Sending Money To Dead People Wrong Accounts During Coronavirus Pandemic Abc11 Raleigh Durham

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Stimulus Checks Tax Returns 2021

Qualified Disaster Distributions Vs Stimulus Checks What Are The Differences Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Americans Struggle To Receive Missing Stimulus Checks

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc11 Raleigh Durham

Waiting For A Check That Never Came

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Third Stimulus Check Update How To Track 1 400 Payment Status Abc10 Com

Pros And Cons Of Stimulus Check Economic Impact Payment

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

![]()

1 400 Stimulus Check Tracking What Error Messages Payment Status Not Available Means

Stimulus Check Update On Monday April 6th Stimulus Package Youtube Tax Extension Irs Tax Forms Irs Taxes

The Irs Stopped Accepting Direct Deposit Requests On May 13 That Doesn T Mean You Won T Get A Check However Irs Filing Taxes Deposit