irm stock dividend safety

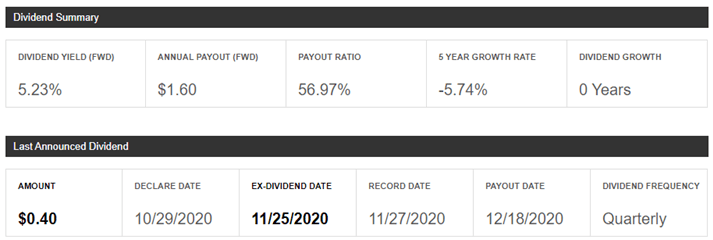

The payout ratio for IRM stock is 89 thanks to the steady nature of the business. In fact Iron Mountain boasts a customer retention rate of 98 and more than half of the boxes stay at its facilities for 15 years on average.

Cut These Dividend Stocks Before They Cut Seeking Alpha

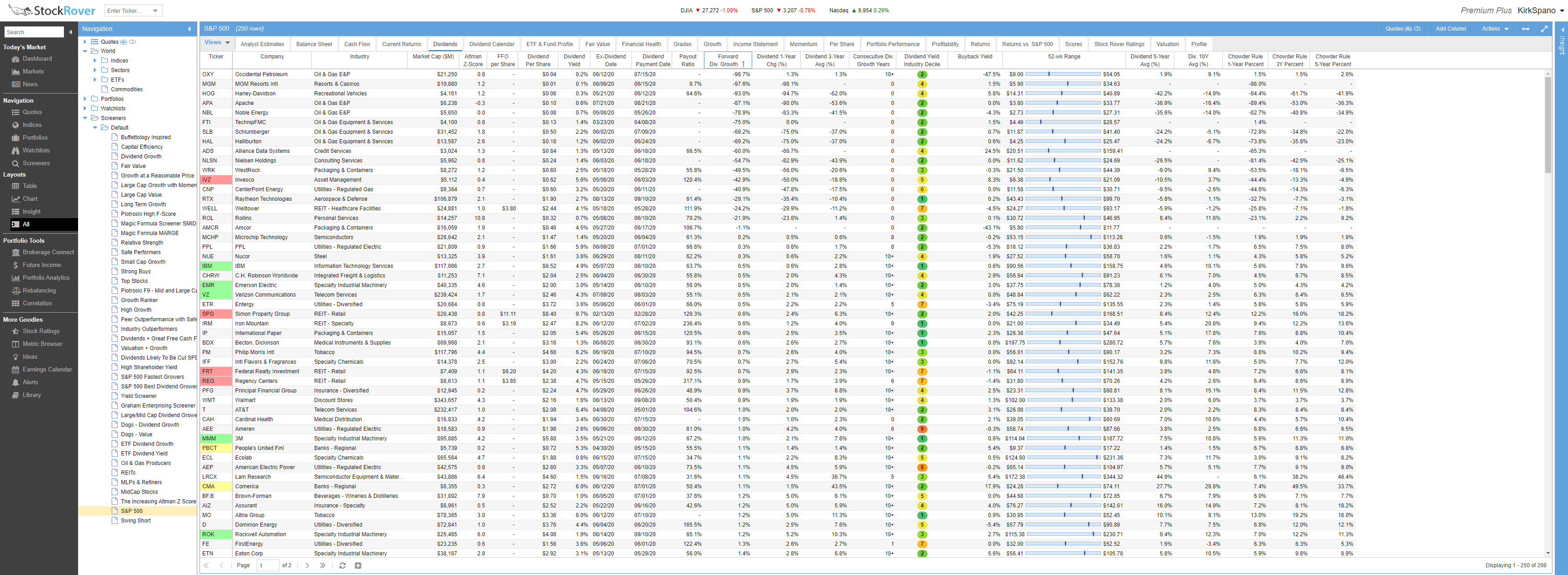

It was no surprise to see that these higher-yielding stocks had more suspect dividend safety.

. Iron Mountain Incorporated IRM dividend safety metrics payout ratio calculation and chart. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. This high-dividend stock has seen the dividend increase 776.

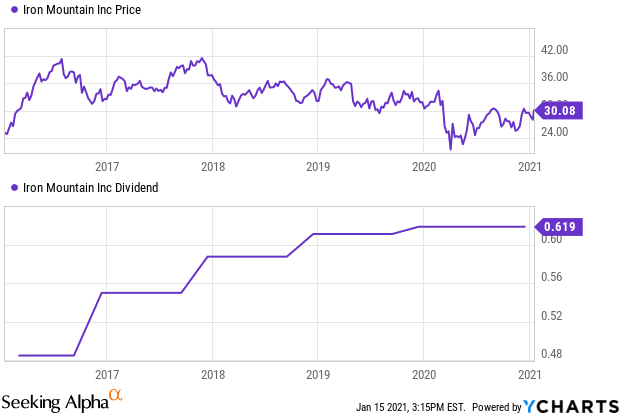

Over the past six years Iron Mountains dividend has seen an increase. Iron Mountain Incs NYQIRM heavily geared balance sheet. Ad How this fund beats the SP in bull and bear markets.

When reviewing Iron Mountains dividend profile keep in mind that the. Dividend yields this high often are unsustainable especially for companies paying out more in dividends. Investor Presentation January 2020 Iron Mountain Inc last accessed February 28 2020 Ultimately like all stocks IRM could go up or down in 2020.

International Business Machines Corporation IBM dividend safety metrics payout ratio calculation and chart. Rating as of May 3 2022. Based On Fundamental Analysis.

Iron Mountain IRM Dividend Data. Best dividend capture stocks in May. Quote Stock Analysis News Price vs Fair Value Sustainability Trailing Returns Financials Valuation Operating.

When is Iron Mountains next dividend payment. It pays a dividend yield of 480 putting its dividend yield in the top 25 of dividend-paying stocks. Both of these figures are below the 10x safety threshold for Iron Mountain Inc that we have set.

Find the latest Iron Mountain Incorporated IRM stock quote history news and other vital information to help you with your stock trading and investing. Reviewing Iron Mountains Dividend Safety First its worth noting that a major reason why junk bond yields spiked in 2018 is due to fears of another prolonged oil crash. Not necessarily Iron Mountain has raised its regular dividend in nine out of the last 10 years and it has increased it by 30 over the last five years to 062 quarterly.

The previous trading days last sale of IRM was 464 representing a -199 decrease from the 52 week high of 4734 and a 9044. And secondary offerings arent. How this fund did well in bull and bear markets.

One way to analyse dividend safety is to focus on a companys balance sheet. More Other News. During the third-quarter conference call Iron Mountain announced that dividend growth would be slowing down so it could free up more cash to.

Stock falls Tuesday underperforms market 051022-402AM EST MarketWatch. This suggests that the dividend could be at risk. In fact this score is one of the better ones across the REIT sector.

Iron Mountains next quarterly dividend payment of 06180 per share will be made to shareholders on Saturday July 16 2022. Maintaining a strong balance sheet helps further the distribution safety. Let Dividend Stocks Protect You From The Bear Market 051022-445AM EST TalkMarkets Iron Mountain Inc.

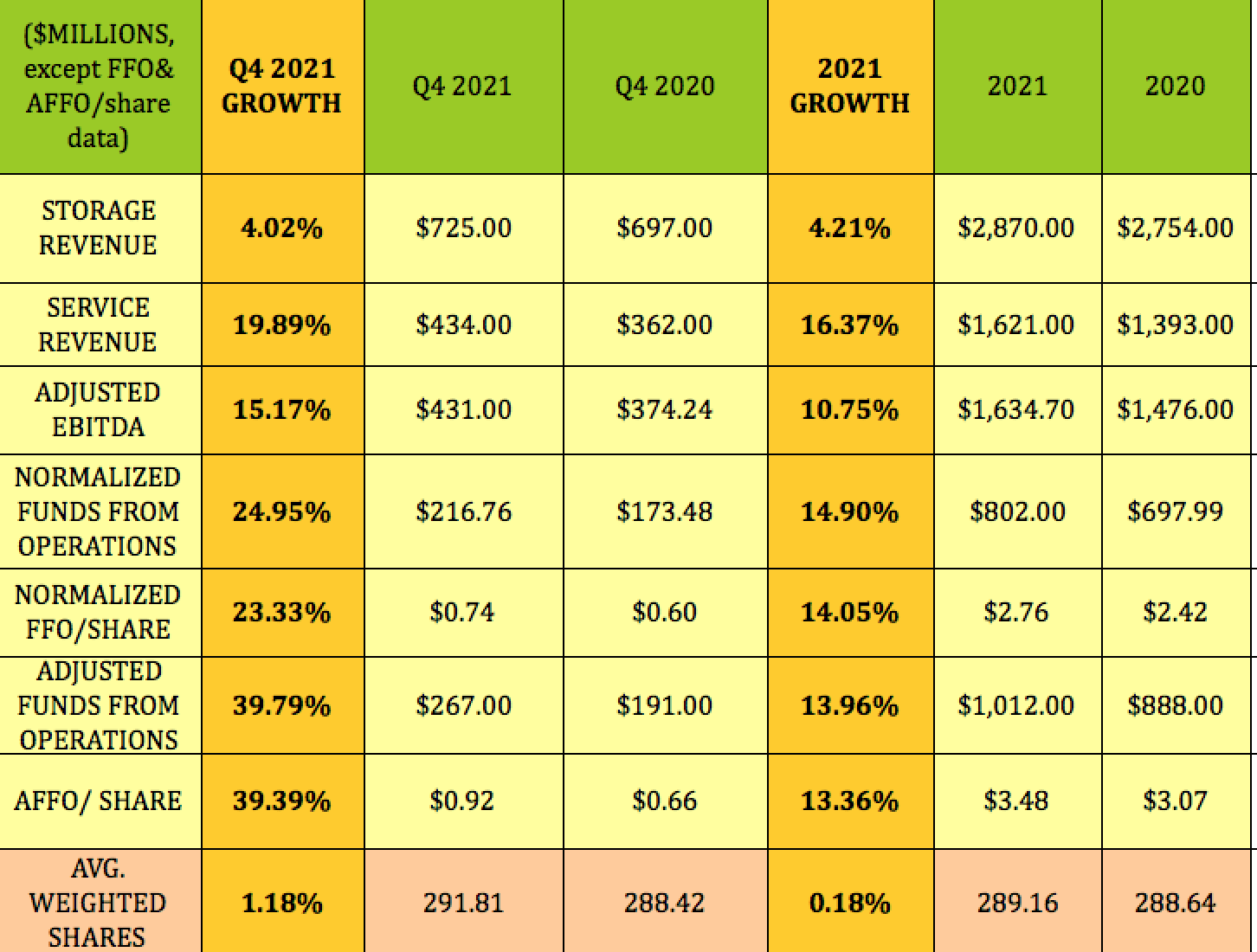

The company has an adjusted funds from operations AFFO payout ratio of 78 which indicates that the dividend is well covered. Payout Ratio FWD Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount. Iron Mountains IRM stock price has declined 16 since peaking in late November 2017 worse than the SP 500 down 1 and the broader REIT index down about 9.

With a dividend yield of 53 stock sales are a little expensive. But with a safe and growing dividend stream that already yields 82. This group was comprised of 5 stocks 3 of which sport high dividend yields in Altria Group MO Iron Mountain IRM and Omega Healthcare Investors OHI.

The stock has a current dividend yield of 5 which is highly attractive for income investors. Iron Mountain is a leading dividend payer. At the current stock price of 464 the dividend yield is 533.

You are providing consent to Iron Mountain to send you the requested Investor Email Alert updates. Declaration Date Type AmountShare Record Date NYSE Shares Payment Date ASX CDI Payment Date. Just a shade over 10 of my dividend income is rated Borderline Safe.

Iron Mountain Inc - Stock Dividends. This is all good news for dividend safety right. Iron Mountain has quarterly dividends of 618 equaling 2474 in annual payouts and a dividend yield of 939.

Finally theres dividend growth and dividend safety. Ad Our Strong Buys Double the SP. The dividend payout ratio of Iron Mountain is 16144.

Iron Mountain Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets there is a limit to how much expansion can ultimately be achieved from this profitable core business especially as more companies move to paperless ie. Iron Mountain Incss historic dividend cover is 043. Iron Mountain does not have a long track record of dividend growth.

But Iron Mountain has a consistently high payout ratio of more than 100 using. The current payout for IRM stock is 0485 or 578 per share based on a price of 3357. The average REIT using Vanguard Real Estate Index ETF as a proxy has a yield of just 22.

Iron Mountains Dividend Safety Score of 65 indicating that the REITs dividend is safe and dependable. It divides the Forward Annualized Dividend by FY1 EPS.

8 Highest Dividend Stocks In S P500 Dividend Stocks Budgeting Money Finance Investing

Dividend Stocks What They Are And The Top Performers Gobankingrates

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain S 8 2 Yield High Risk High Reward Nyse Irm Seeking Alpha

Top 100 High Dividend Stocks Including Dividend Safety Score

Stag Industrial Stag Monthly Dividend Safety Analysis

9 Dividend Stocks With Yield Up To 9 Otcmkts Ablzf Seeking Alpha

Top 100 High Dividend Stocks Including Dividend Safety Score

Top 100 High Dividend Stocks Including Dividend Safety Score

Top 100 High Dividend Stocks Including Dividend Safety Score

Iron Mountain Stock Record Earnings 5 Yield 10 Growth In 2022 Nyse Irm Seeking Alpha

Dividend Stocks Can Make You Rich 2 Utility Stocks To Consider Buying Now The Motley Fool

Dividend Stocks Can Make You Rich 2 Utility Stocks To Consider Buying Now The Motley Fool

Is Iron Mountain Inc S 9 2 Yield Safe

Top 100 High Dividend Stocks Including Dividend Safety Score

Dividend Sensei S Portfolio Update 14 Want To Retire Rich Then Choose Your Next Car Carefully Seeking Alpha Dividend Dividend Income How To Become Rich

The 8 Dividend Sleeve Seeking Alpha

Dividend Stocks 9 High Yield Stocks With Little Risk Of A Dividend Cut Investorplace

7 Tech Stocks That Pay Dividends Virtual Data Room Laptop Screen Data Room